|

|

|---|

Saturday, October 31, 2009

Automotive sector – shifting up a gear

Saturday October 31, 2009

Brought to you by:

MAYBANK-IB Watch

Maybank Investment Bank

By "faudziah"

Automotive sector – shifting up a gear

THE fresh National Automotive Policy (NAP) measures are a short-term neutral but long-term positive, and offer a decent roadmap to the domestic automotive industry. The policy is pro-investment and embraces liberalisation without hurting the national car plans.

A timetable to phase out approved permit (APs) and the introduction of a vehicle end-of-life policy is commendable. The pursuit of green car development will turbo-charge the industry, if executed well.

The plan to issue new manufacturing licences for selected segments, including high engine capacity cars, with 100% foreign ownership, suggests that Malaysia is heading in the right direction in liberalising its automotive sector, transforming it from pro-national car into a regional manufacturing hub, akin to Thailand.

Interestingly, the policy is structured so that it does not hurt further development of the national car programme and franchise holders. It encourages new foreign direct investments without competing directly with local players such as Proton, Perodua, Inokom, Naza Kia (MPV model only), Isuzu-HICOM and Modenas (motorcycles), predominantly in the below1,800cc (cars) and below 200cc (motorcycle) categories.

Proton stands to gain most as the majority of its products are below the 1,800cc segment, and it can offer contract assembly, as it is currently running at 40% of its production capacity.

Other beneficiaries are Tan Chong Motor Holdings Bhd, UMW Holdings Bhd and MBM Resources Bhd (via 38% and 20% stakes in Perodua).

The timetable to gradually phase out the AP system by December 2015 (open APs) and December 2020 (franchise APs) is commendable. It allows existing AP holders to diversify and venture into other businesses.

Terminating the AP system will encourage development of an auto assembly hub. Beneficiaries are automakers and franchise holders who already have assembly presence in Malaysia, namely Proton, UMW and MBM (via Perodua), Tan Chong, DRB-HICOM, Inokom, and Naza.

Meanwhile, implementing a 15-year vehicle end-of-life, which is akin to the scrapping policy, will benefit the industry in terms of replacement cycle, and ties in well with the measure to introduce rigorous vehicle testing standards.

Policy implementation could be unpopular with the rural/lower income group if no rebates are tied to it. Nonetheless, implementation of a 15-year life-span is still high compared to Singapore (10 years).

We are however disappointed that the current RM5,000 non-cash rebate for trade-in of old vehicles enjoyed by Proton and Perodua owners has not been extended to the other marques.

The green car programme is globally new but could turn out to be Malaysia’s “product champion”, if executed well. The global market offers a potential of 11 million units. The incentives for hybrid/electric car development are on par with Thailand’s, which could entice prospective manufacturers/assemblers.

Thailand has a headstart over Malaysia in attracting green car investments but Malaysia is still ahead of the rest. Thailand has managed to rope in 6 OEMs (Honda, Mitsubishi, Toyota, Tata, Nissan and Suzuki) in setting up the eco-car project there.

Honda will commence production in 2010 and the other automakers will start in 2011 (full capacity by 2015: 700,000 units p.a.).

Proton’s search for a strategic partner is not new but being incorporated into an official policy further validates our view that a foreign partner is needed for its long-term competitiveness. Volkswagen and Renault are among the heavyweight names touted to partner Proton.

An established foreign partner is vital to Proton’s long-term competitiveness as Proton needs (i) technical expertise (i.e model development), (ii) marketing expertise and cost synergies (i.e. higher utilisation at its Tanjung Malim manufacturing plant; currently at 40%, lower R&D costs), (iii) new sales markets.

These synergies would eventually enhance shareholders’ value.

We are surprised that the revised NAP did not clear up the definition of a national car. For the consumers, with no change to sales, import and excise duties, vehicle prices are set to remain unchanged.

We maintain our earnings forecasts for auto stocks under our coverage, as the industry makeover will be gradual. Overall, Proton is a clear winner. UMW, Tan Chong and MBM do not lose out either.

We lift the sector to Overweight following recent upgrades to Proton and Tan Chong. We continue to recommend Buy on Proton (target price: RM5) and Tan Chong (RM3). Maintain Hold on MBM (RM2.40) and UMW (RM6.35).

END OF SOURCE.

References:

1) http://biz.thestar.com.my/news/story.asp?file=/2009/10/31/business/5014538&sec=business

That's all folks, thanks for having the time and patience to read this WONDERFULLY WRITTEN ARTICLE...

Who' s footing the bill? By IZWAN IDRIS

SOURCE 1: The Star, StarBizWeek.

Saturday October 31, 2009

Who’s footing the bill?

By IZWAN IDRIS

"THE Government dished out a whole lot of fresh manufacturing goodies after it reviewed the National Automotive Policy (NAP), which can be described as an attempt to improve on the flawed original.

But with car prices being kept at prohibitively high levels, consumers cannot be faulted if they feel like they are the ones footing the bill to keep the industry alive.

“It was a positive NAP for market players, but not so for consumers,’’ MIDF Research analysts Zulkifli Hamzah and Wan Azhar Mustapa said in their commentary on the industry.

Malaysia is set to remain among the countries with the highest numbers of new car buyers after the International Trade and Industry Ministry said on Wednesday that it would keep import duty and exercise duty structures for motor vehicle at the current rates.

Any price reduction, the Government said, would have to come from the industry.

As it is, most analysts as well as market players, including Malaysian Automotive Association president Datuk Aishah Ahmad, expect car prices to remain the same, at least for the rest of the year.

Under the Common Effective Preferential Tariff scheme, Malaysia must eliminate import tariff for CBU (completely built up) vehicles produced in the region before Jan 1, 2010, to comply with the Asean Free Trade Area (Afta) agreement.

Currently, there is a 5% import duty imposed for CBU cars and motorcycles under Afta.

International Trade and Industry Minister Datuk Mustapa Mohamed said the Government was committed to honouring all its international obligations.

There is a chance for a slight price reduction for CBU car imports from neighbouring countries, but the final sticker price will depend on the respective car dealers’ marketing and sales strategy. One CBU model imported from Thailand into Malaysia is the Toyota Camry.

The Camry comparison

(SOURCE 2).

So how much does a Toyota Camry cost here and how does it compare to the rest of the region, and everywhere else, for that matter?

The 2.4 litre automatic version carries a sticker price of about RM260,000 in Singapore, which is higher compared to RM176,000 for a similar unit at local showrooms.

A check through the web revealed that the Camry is priced at about RM160,000 in Jakarta and just above RM150,000 in Thailand.

Meanwhile, a survey on households by CLSA published recently showed that the Camry in Malaysia has the second highest showroom price tag in Asia, behind Singapore, of course, but ahead of Hong Kong.

The car was priced between US$30,000 (RM102,000) and US$34,000 (RM115,000) each in China, Japan, the Philippines, Taiwan and Britain.

The Camry is the cheapest in the United States and Australia, where the sticker price is less than half of the one quoted at local (UMW) dealerships.

Of course, it can be argued that the actual cost of owning a car varied from country to country after taking into account other things such as fuel, parking fees, regular maintenance charges, road tax and insurance.

Also the same car may actually be of a slightly different specification and styling to suit local needs and conditions.

The Camry model is targeted at executives in most markets. In Malaysia, the Camry competes with MPVs and SUVs at a price range of between RM150,00 and RM200,000.

In the entry-level segment, the cheapest new cars in Asia can be bought in China and India. Most entry-level cars in markets surveyed by CLSA are priced below RM35,000 per unit. In Singapore and Hong Kong, the cheapest new car available starts from RM60,000 each.

Despite the relatively high local new car price, MAA expects the annual total industry volume (TIV) to remain above half a million units over the next three years.

Taxing burden

Under the revised NAP, the Government aims to boost foreign direct investments (FDIs) in the sector, but is careful not to antagonise supporters of the national car makers.

“There are seven policy thrusts detailed in the NAP, and we believe it has managed to successfully balance continued protection for Proton, whilst encouraging FDIs,’’ RHB Research Institute said.

The improved tax and incentives given to automotive components would benefit existing local exporters, as well as attract new players to set up shop in the country.

The prohibition of imported used parts will also force consumers to switch to using products by original equipment manufacturer (OEMs) and replacement equipment makers (REMs).

Meanwhile, there is a plan to gradually phase out older cars from Malaysian roads and to implement more rigorous safety checks on vehicles. However, no deadlines were given.

The MIDF analysts expect the development of the end-of-life vehicle (ELV) policy to be a slow process, given the “sensitive” nature of the issue.

One thing for sure, OEM and REM parts will cost more compared to used items and Malaysians will have to dig deeper into their pockets to maintain their vehicles.

And the prohibitively high sticker price for new cars out there continue to put better quality cars out of the reach of most Malaysians.

Based on current duty and tax structure, the effective rate for the Toyota Camry 2.4 stood at 185% of the CBU price. Basically, more than half of the sticker price at the local dealerships is attributed to duties and taxes.

Exercise and import duties collected from car sales contributed billions to the Government’s coffers every year, with some estimates putting it in the range of between RM6bil and RM7bil annually.

However, it can be argued that the high prices limit the industry’s growth potential. And it is unfair to car buyers to continue shouldering the financial burden of ensuring that domestic car makes remain competitively priced."

END OF SOURCE.

SOURCES:

1) http://biz.thestar.com.my/news/story.asp?file=/2009/10/31/business/5008187&sec=business

2) http://www.toyota.com.my/index.aspx?cat=models§=camry&subsect=gallery

That's all folks, thanks for having the time and patience to read this WONDERFULLY WRITTEN ARTICLE. Again, I REALLY REALLY WISH I CAN WRITE SUCH GOOD ARTICLE. But Not at the moment...

Coming to grips with APs. By IZWAN IDRIS

SOURCE: The Star, STARBIZWEEK

Saturday October 31, 2009

Coming to grips with APs

By IZWAN IDRIS

THE Approved Permit (AP) system to import cars into the country is often a contentious issue, one that even the Government seems to be having a hard time getting rid of.

Abolishing the well-entrenched system means taking on a group of wealthy bumiputra businessmen, whose strong ties to the political elite makes them formidable opponents.

On the other hand, the general perception is that the AP system is riddled with abuses. And the suspicion seems to be validated by facts.

Recent audits by the International Trade and Industry Ministry (Miti) have come up with the conclusion that a number of AP recipients continue to “misuse and abuse” their allocations.

Minister Datuk Mustapa Mohamed confirmed that some AP holders sold their car import permits to third parties for quick profits. However, he did not elaborate on this. Meanwhile, a check with several re-conditioned car dealerships in Klang Valley yielded claims that forgery of AP documents still goes on.

According to Mustapa, some companies have had their AP allocations for 2009 slashed based on recent audit findings due to various reasons. He added that while no new AP application would be entertained, future allocations would take performance into consideration.

The ministry, however, gave no details on the number of APs issued so far this year and to whom they were given.

In fact, the last time a full list of AP recipients were made public was in 2005, following a huge debate over the issue. That year, names like the late Tan Sri SM Nasimuddin SM Amin of Naza Group, Datuk Syed Azman Syed Ibrahim of Westar Group and a few others made headlines due to the huge amount of APs given to them.

U-turn

The National Automotive Policy (NAP) was first introduced in 2006 and one of the key aims was to abolish the AP system by 2010. But on Wednesday, when announcing the review of the NAP, the Government pushed the deadline to 2015 for open APs, while the franchise AP system will continue to be in place for another decade.

The move to postpone the abolishment of the much maligned AP system was not totally unexpected.

On Oct 23, in presenting his first budget, Prime Minister Datuk Seri Najib Tun Razak said the Government would start imposing a RM10,000 charge for every open AP awarded from next year onwards.

This may be the AP holders’ only concession in exchange for the extension announced on Wednesday by Miti.

“Finally, closure on this issue, hopefully,’’ said Maybank Investment Research head Andrew Lee in his take on the AP system’s new deadline.

The system was introduced in the 1970s as part of a strategy to encourage bumiputra participation in the automotive industry.

In its current form, the so-called open APs are given to bumiputra entrepreneurs to import any vehicles from overseas, while car distributors are given franchise APs, which are restricted according to models and brands.

Miti’s data showed that the number of companies that are eligible for AP allocation stands at 98 today, compared to 254 in 1987.

According to Miti officials, the number of APs issued are limited to 10% of the total industry volume (TIV) recorded the previous year. It is a sort of import control for foreign vehicles sold in the country.

Assuming that the TIV this year will match the Malaysian Automotive Association (MAA) target of half a million units, about 50,000 APs can be issued next year. Of this amount, 60% will be allocated for open APs, while the rest as franchise APs.

The Government’s plan to sell the open APs – they were given free in the past – will contribute as much as RM300mil in revenue every year for the next five years.

A portion of the money will be channelled into a fund to help bumiputra car dealers wean off their dependence on APs.

“It is extremely lucrative and risk-free ... It is easy to see why (AP holders) will not give up the business,’’ stockbroker Kenanga Research said in a recent update issued after the NAP review. The firm estimated that open APs has a “street value” of about RM40,000 each.

Most of these AP holders purchase used cars in overseas markets – the current hot models are the Japanese MPVs – which are then sold here as re-conditioned cars at a good margin.

Post 2015, after the abolishment of open APs, will the quota for AP issuance remain at 10% of TIV? Will the open APs be converted into franchise APs in the period leading to 2020?

One sure thing is that demand for imported cars will remain. Given the capital accumulated over the years and the expertise and network built up, open AP holders can easily transform their business and become official distributors.

The Naza Group is the most well-known among the existing crop of AP holders to have taken this route. Westar is another example.

Today, control of the Naza group remains with Nasimuddin’s family. Over the years, the group has built up its empire to include property and construction, as well as in food and beverage. But the group’s bread-and-butter business lies firmly in its automotive roots.

Another of these so-called AP Kings, Weststar Group, had in June aborted a plan to acquire a British-based van maker LVD Group Ltd. Like Naza, Westar’s car showrooms are situated at prominent locations around the Klang Valley area.

While the two firms were often cited as proof that the AP system had actually work, what about the rest? But the real question to ask is whether an open tender system would be a better alternative?

The deadline for the dismantling of the AP system is a long way off. It was put off before, and it may possibly continue to haunt policymakers for a long time."

END OF SOURCE.

REFERENCES:

1) http://biz.thestar.com.my/news/story.asp?file=/2009/10/31/business/5007860&sec=business

That's all folks, thanks for having the time and patience to read this interesting, neutral (politically-correct), well-written article...

200th post: National Automotive Policy – still stuck in neutral

SOURCE: The Star, The StarBizWeek, Saturday October 31, 2009

National Automotive Policy – still stuck in neutral

By JAGDEV SINGH SIDHU

"The National Automotive Policy has been revamped to now include several new measures. But are they enough to move Malaysia’s auto industy ahead of its regional rivals?"

"WHEN International Trade and Industry Minister Datuk Mustapa Mohamed admitted at a press conference on Wednesday that Malaysia was behind Thailand in the auto industry, there were no gasps of disbelief nor expressions of shock.

However, there must have been a reflection of regret that Malaysia has lost much ground after it had stormed into the lead in the regional auto business when it launched the national car project in the mid-1980s.

Now, we have been overtaken by a neighbouring country that has basically given its investors the very things that have been asked of the Malaysian government all this time.

The “loss” to Malaysia may amount to billions of dollars and employment opportunities many times the size in Malaysia that have migrated northwards. This time around, though, the Government intends to rectify the situation.

Although the broad objectives of the national auto policy (NAP) review do not deviate much from the original policy announced in 2006, the Government has spelt out its intention of growing the industry and developing its long-term competitiveness with a slight twist.

“Given the strengths and weaknesses of the Malaysian automotive industry, the Government’s move to focus on high value added segments makes sense,” says Kavan Mukhtyar, partner and head of automotive and transportation practice, Asia Pacific, Frost & Sullivan.

“By focusing on the luxury vehicle, electric vehicle/hybrid/precision engineering segments, the Government hopes to attract high value added new investments without competing directly with Thailand, and at the same time continuing support for the national car makers that focus mainly on the compact and sub-compact vehicle segments.

“The NAP review has also clearly signalled that Malaysia will go through the process of gradual rather than rapid liberalisation. The clear timelines attached with the liberalisation process give enough time for the domestic players across the value chain to become regionally competitive or to diversify into other businesses.”

One of the main differences between the 2009 auto policy and its predecessor is the granting of full-fledged manufacturing licences to foreign auto companies, in categories that do not compete with the national passenger car players.

“Considering the competition from Thailand, which has firmly established itself as the ‘Detroit of Asia’, the lifting of the freeze on manufacturing licences is a good move that puts Malaysia on the right path to attracting foreign direct investments by global carmakers wishing to expand their operations in the region,’’ said CIMB Research in a note.

Turning to Europe

The carte blanche given for new manufacturing operations of certain type of cars, such as those above the 1,800cc and RM150,000 in value, is a start, but the issue is, will manufacturers bite?

There is a school of thought that foreign car companies from Europe may pay a little more attention to the measured liberalised environment in Malaysia.

OSK Research, in its note on the NAP, points out that Thailand trumps Malaysia on incentives as it offers lower excise duties on vehicle prices and the exemption of import duty on plant machinery, in addition to having an already established supply chain.

The only problem is that to qualify, investors need to fork out a huge sum of money, the minimum being RM1bil.

“To date, Thailand has seven global OEMs (original equipment manufacturers) and a few smaller ones that have set up plants with capacity totaling 1.625 million units as of 2008. These are mainly OEMs from Japan (Toyota, Mitsubishi, Isuzu, Honda, Nissan) and US (Ford and General Motors).

“As none represents the European region, we may potentially see Malaysia trying to attract global OEMs from this region instead. This was hinted in the announcement, with respect to relaxation of the ruling on foreign manufacturers in the luxury passenger car segment,’’ said the research house.

Having competitive incentives is one thing, but the years of distrust and doubt that foreign players have built up against the direction of Malaysian auto policy, is working against the possibility of them committing huge sums of money in the future.

“Fiscal incentives and flexibility in ownership are just a few factors to attract FDI (foreign direct investment). Foreign investors will evaluate the entire ecosystem in Malaysia, including the availability of supporting supplier industries, access to regional markets, domestic demand, availability of human resources,’’ says Kavan of Frost & Sullivan.

“For example, to become a manufacturing hub for hybrids/electric vehicles, Malaysia also needs to have an attractive home demand for such products. Follow-on measures will be critical in creating an attractive ecosystem for foreign investors in the high value added segments.’’

He feels Malaysia’s biggest challenge is to strengthen the supplier base and help those suppliers develop competitiveness.

“In summary, the NAP review will definitely attract attention from the foreign investors but actual flow of investment will depend on how the entire automotive ecosystem responds to this opportunity,’’ Kavan says.

Note: Please double click to enlarge...

Time to change

The main thing the NAP has failed to do is to cut tariffs and consequently, the price of vehicles in the country. Maybe this is due to the already huge strain on the government budget, which has been running deficits for more than a decade now.

“Most of the consumer-centric measures are more towards improving safety standards and the environment friendliness of the vehicles. In the short term, imports of used CBU (completely built up) imports may be constrained as gazetted prices will be used for duty computation,’’ says Kavan.

“Consumers in the luxury segment may benefit in the medium term if foreign automakers make Malaysia their hub for vehicle manufacturing.”

The NAP also manages to liberalise the auto sector while still giving protection against the national car makers, a stance the Government has not wavered from, since starting the national car policy in the mid-1980s.

Whether that is an acceptable to the rest of the industry is moot, but there are quite a number of people who feel that is not the right way to go.

“(There is) still ample protection for national producers, including maintaining high excise and import duty structures, extension of freeze on assembly of rebuilt commercial vehicles such as trucks and buses. And, the liberalisation of manufacturing licences does not encroach into the mass market segment, which the national producers currently serve,’’ UOBKayHian points out in its note.

And there are people in the industry who feel the time has come for that to change.

“We have to look at the national auto industry in particular and not only focus on the national car company alone,’’ says DRB-HICOM Bhd group managing director Datuk Mohd Khamil Jamil.

“Having the technology and product for the domestic market alone is insufficient. We must also be accepted by the market overseas, at least regionally.’’

Khamil feels that a collaboration with a strategic partner is important in promoting and enhancing the capabilities and opportunities of Proton and the industry.

Malaysia is a country that has a long history of making cars. Notwithstanding the national makes, the employees of the industry are widely regarded as trainable and skilled. Just ask Mercedes Benz.

Its plant in Pekan, Pahang, started out making four units a day of just one model. Today, it assembles the S-class, E-class and C-class Mercs, and annual volumes has now reached 5,000 units. That makes it the largest CKD (completely knocked down) assembly outside Germany.

Picture above: NEW PROPOSED MOTOR VEHICLE TAX AND DUTIES STRUCTURE vs OLD...

“Consolidation and strategic alliances within the industry is important as many major manufacturers are moving towards multiple brands sharing the same engineering platform,” says Khamil.

“Asean is a high-growth region for the automotive business. There are threats of new markets like Vietnam and the Philippines. So we have to entrench our position.”

Changed, but still the same

The crux of the issue in Malaysia has been overcapacity, competitiveness and the lack of exports. Khamil feels that future growth will have to be export-led, and Malaysia needs to establish its position as an auto manufacturing hub.

“There must be a balance between the national car brand and enabling a sustainable auto industry,’’ he says.

While the auto parts manufacturers would welcome the NAP, the other winners from the entire review would surely have to be the national car makes,” he adds.

The greater tax exemption for exports of vehicles will benefit Proton and Perodua, but analysts feel those companies would need to produce cars that are competitive on a global scale in order to greatly gain from such incentives.

That will entail additional costs to engineer such cars, making it essential for Proton to form a strategic partnership with a larger foreign player. Proton and Volkswagen are engaged in talks to reach such an arrangement.

While the NAP review is a step in the right direction, many things need to be in place for the measures to materialise into something significantly tangible.

“On a whole, the measures are unlikely to have much immediate impact on the auto sector. Most of the measures announced – albeit being positive in navigating the industry towards greater liberalisation and competition – are not significant enough to alter the prevailing industry dynamics. In a way, the scenario, duties and ultimately, car prices, have not changed,’’ said Affin Investment Bank in a research report."

END OF SOURCE.

References:

1) http://biz.thestar.com.my/news/story.asp?file=/2009/10/31/business/5013872&sec=business

That's all folks, thanks for having the time and patience to read this LONG Article...

2001 Peugeot 206 CC

Specifications

Engine Type 2.0 Liter Turbocharged Inline-4

Displacement cu in (cc) 1997 cc / 121.9 cu in

Power bhp (kW) at RPM 138.00 HP (101.6 KW)

Torque lb-ft (Nm) at RPM 150.00 Ft-Lbs (203.4 NM) @ 1900.00 RPM

Redline at RPM n.a.

Brakes Vented Discs

Tires 175/65 14

Length 151.001 in | 3835.4 mm.

Weight 2310 lbs | 1047.8 kg

Acceleration 0-62 mphs n.a.

Top Speed mph (km/h) 180 km/h | 111.9 mph

Fuel economy EPA (1/100) n.a.

Base Price n.a.

2000 Peugeot 607 Feline

Specifications

Engine Type 2.9 L V6

Displacement cu in (cc) 2946.00 cc | 179.8 cu in. | 2.9 L.

Power bhp (kW) at RPM 210.00 BHP (154.6 KW) @ 6000.00 RPM

Torque lb-ft (Nm) at RPM 285.00 NM (210.1 Ft-Lbs) @ 3750.00 RPM

Redline at RPM n.a.

Brakes Carbon Brembro Vented Discs

Tires n.a.

Length 160.001 in | 4064 mm.

Weight 1900 lbs | 861.8 kg

Acceleration 0-62 mphs 5.90 seconds.

Top Speed mph (km/h) 250 km/h | 155.4 mph

Fuel economy EPA (1/100) n.a.

Base Price n.a.

Friday, October 30, 2009

Longtermer #1, Update 16: Ford Telstar Ghia i4 16v

In this blog entry, I am updating my Ford Telstar i4 Ghia. This is the 16th update.

What's up in the month of October?

Well, lots of things to highlight. Firstly, the FUEL CONSUMPTION(FC)'s REALLY back to normal. Averaged 6.8km/L. The worst was recorded in 7 October => 5.6km/L (BHP),

while the best was 7.9km/L joint honours between MOBIL 5000 RON95 and Shell RON95 FUELSAVE. Petronas RON95 is in the middle at 6.8km/L. Haven't try Caltax yet.

Other than that, remember the "leaking thingy" I mentioned last month, well, I was relieved that the gearbox and driveshaft still working despite leaking (hairline cracked). Let's hope it lasts till 1st week of November where I have the dough to fix it...

Also, This Telstar unleashed the Kiasu in me... I taught few Vios (3x - 2 of them are AH BENG Vios with Goalpost spoiler, bodykits and LARGE Exhaust), MyVi 1.3 and a Camry 2.4 (Previous Gen) some lesson. Dare to flash me (Camry)? Dare to overtook from Left and ZIGZAGGING (All Vios(es) and Myvis)? I SMOKED THEM... Happy to said that I managed to KEEP up with Mercedes S320L (Previous Gen) who tailgated and flashed me... I let him pass and followed his tail for good 10kms in NKVE before I turned into Subang Interchange and the S320L driver going straight to Klang.

Well, as usual there’s always the bad news. My front 2 tyres "BOTAK" already (see 2 pictures below, 1st one below shows the front left tyre while the 2nd one shows the front right tyre).

Above: Front right tyre...

As a result, I had two times aquaplaned. Once U-turn to Sprint Highway (before Shell 17/21), the car just went straight, I just lift off the accelerator and managed to regain steering control.

Second time, on the way back from Jalan Ipoh to Jalan Duta. Was travelling 100km/h on wet roads (drizzling that time), going down the flyover, suddenly saw traffic ahead. Hard braked, the Telstar swayed to the left and right (slightly), before I regained my steering control (again lifting off the accelerator). Thank God the Hyundai Matrix in third lane and another Telstar behind me noticed my car swaying left to right and slowed down... If not...

As I am typing this, the Telstar only done 148,048km. Previous month, it's 147,222km. It covers >1000km per month. WOW, fascinating... Why?

As I am using my dad's Civic FD2 2.0iVTEC more often... Especially when my dad's overseas.

Without further ado, here's the LOGBOOK:

Year of manufactured: December 1998 (registered January 1999)

Purchase price: RM42,000 (Aug 2005)

Current value: RM13,000 (As at August 2009)

Depreciation per year (averaged): RM10500

Mileage last month: 147,222km (26 September 2009)

Mileage now: 148,048km (29 October 2009)

Fuel consumption (so far):

BEST: 10km/l (25 August 2009)

WORST: 5.6km/l (October 7, 2009) => 100% City driving

THIS MONTH (October):

WORST: 5.6km/l (October 7, 100% City driving) (BHP)

AVERAGE: 6.8km/L (mixed)

BESI: 24 October 7.9km/l (Shell improved)

0-100km/h: 10.4 secs (27/9/2009). Previous run 10.8 secs (25 Aug 2009).

TODAY, As at 30th October,

Expenses (this month)

1) Fuel expenses (RM200)

2) Parking and tolls charges...

Before I go, a picture's worth 1000 words. Here's some pictures...

Check out the LARGE Boot... 1 month's grocery without needing to Split/fold the rear seatbacks...

My Telstar, as seen from my house compound...

Here's a parting shot above. LONELY... My Telstar is LONELY... As everyone went back home... Holy Matrimony wedding Over...

End of Update, thanks for having the patience to read it... See you next month on End-November.

AN ORIGINAL JEFF LIM PRODUCTION (My original work)

peugeot rc total diester cup

Thursday, October 29, 2009

Tuesday, October 27, 2009

NEW TOY: CASIO PROTREK PRG-80T-7V

It comes with 1 year worldwide warranty. Overall, I enjoyed my new toy. MORE FEATURES than my TISSOT(R) T-TOUCH(R) which was given by my dad for birthday back in 2003.

Without further ado, here's some information, photos and specifications of my new toy...

Name: CASIO Protrek Triple Sensor PRG-80T-7V

Serial Number: PRG-80T-7V

Manufacturer Name: CASIO

Other features:

- Electro-luminescent backlight

- Full auto EL light, afterglow

• Solar powered

• Low-temperature resistant (-10 °C/14 °F)

• Digital compass

Measures and displays direction as one of 16 points

Measuring range: 0 to 359 °

Measuring unit: 1 °

20 seconds continuous measurement

Graphic direction pointer

Bidirectional calibration and northerly calibration function

• Altimeter

Measuring range: -700 to 10,000 m (-2,300 to 32,800 ft.)

Measuring unit: 5 m (20 ft.)

Auto memory measurements (up to 40 records, each including altitude, month, date, time)

High Altitude / Low Altitude Memory

Cumulative Ascent / Descent Memory

Relative Altitude Display

Altitude Tendency Graph

Altitude Differential Graphic

Altitude alarm

*Changeover between meters (m) and feet (ft.)

• Barometer

Display range: 260 to 1,100 hPa (7.65 to 32.45 inHg)

Display unit: 1 hPa (0.05 inHg)

Atmospheric pressure tendency graph

Atmospheric pressure differential graphic

*Changeover between hPa and inHg

• Thermometer

Display range: -10 to 60 °C (14 to 140 °F)

Display unit: 0.1 °C (0.2 °F)

*Changeover between Celsius (°C) and Fahrenheit (°F)

• Duplex LC display

• World time

29 time zones (30 cities), city code display, daylight saving on/off

• 1/100-second stopwatch

Measuring capacity: 9:59'59.99'

Measuring modes: Elapsed time, split time, 1st-2nd place times

• Countdown timer

Measuring unit: 1 second

Countdown range: 60 minutes

Countdown start time setting range: 1 to 60 minutes (1-minute increments)

Others: Auto-repeat, progress beeper

• Daily alarms

5 independent daily alarms

• Hourly time signal

• Battery power indicator

• Power save function (automatically disables LCD if the watch is left in the dark for approximately 60 to 70 minutes, and sensor measurements if the watch is left in the dark for six or seven days)

• Auto-calendar (to year 2099)

• 12/24-hour format

• Regular timekeeping: Hour, minutes, seconds, pm, month, date, day

• Accuracy: ±15 seconds per month

• Approx. battery operating time: 6 months on Rechargeable Battery (Operating period with normal use without exposure to light after full charge)

21.5 months on Rechargeable Battery (Operating period when stored in total darkness with the Power Save function ON after full charge)

• Size of case/total weight

PRG-80 : 62.3 X 52.2 X 14.2 mm / 77 g

PRG-80L : 62.3 X 52.2 X 14.2 mm / 76 g

PRG-80T : 62.3 X 52.2 X 14.2 mm / 117 g

PRG-80YT : 62.3 X 52.2 X 14.2 mm / 117 g

References:

http://world.casio.com/asia/wat/protrek/prg_80/

SPECIFICATIONS SUMMARY:

CASIO Protrek Triple Sensor PRG-80T-7V

Series : Protrek One-Touch Operation

Band : Titanium Band

Dial : Water Resistant: 100 M ; Glass: Mineral Glass

Size : 62.3 X 52.2 X 14.2 mm / 117 g

Movement :Solar Quartz

Water Resistant : 100 M

Warranty : One year international manufacturer's warranty

That's all folks, thanks for having the time and patience to read this blog entry...

Monday, October 26, 2009

I'm back and I CUT ALREADY! (18SX)

The reason I didn't post for 2 weeks is because:

i) Preparation of MOTHER'S 60th birthday party bash at Grand Millenium Hotel on 18 October.

ii) Sister's birthday on 23rd October

iii) Lastly, my ADSL Modem struck by lightling back in 3rd October 2009. Hence, I relied on 56k TMNET dial-up modem till TODAY. Hey, can't update much with average transfer speed of 4.1kbps right?

Well, I'm proud to announce: TODAY I FINALLY CUT ALREADY!!!

This is actually the 2nd time I CUT IT...

"WARNING 18SX": 1st time is REAL ONE when I was 14 years old. My "sunroof skin" is too THICK and can't open fully, dad said it'll be pain when making love in future. So he brought me to a hospital... AND CUT IT... Gotta wear SARONG for 3 weeks. Aiya... Long story man. End of the day, after the "surgery" my brother's NOT ONLY CLEANER, BUT grew 1.2" longer and slightly thicker in 3 years (by 17 years old)...

Without further ado, here's one of the funny leaflet found around Klang Valley.

I addition, here's some goodies I found in youtube. They have both the Radio and TV Commercials version which I found it very hilarious. Hence, I decided to share to you readers/followers of my blog:

RADIO ADVERTISEMENTS:

http://www.youtube.com/watch?v=PNSUKNck3kk

Cantonese

www.youtube.com/watch?v=qpwgPZICpHM

Malay

http://www.youtube.com/watch?v=0I_e2jkUTZ8

English

VIDEO ADVERTISEMENTS:

Cantonese 1: (Director's cut)

http://www.youtube.com/watch?v=zjM1OR0d-b4

Cantonese 2: (Director's cut)

http://www.youtube.com/watch?v=vDCCvDiKmEg

Malay version (Director's cut):

http://www.youtube.com/watch?v=CQiZhxvdxHU

That's all folks, thanks for having the time and patience to read this "lame" blog entry...

AUTOS AMERICANOS CLASICOS

Hola gente de T! me doy la bienvenida con esta serie de imagenes de los fierros que mas me copan. Sí, de esos que eran principalmente MOTORRR

Hola gente de T! me doy la bienvenida con esta serie de imagenes de los fierros que mas me copan. Sí, de esos que eran principalmente MOTORRRArrancamos con todo

Chevrolet Corvette Roadster 1958. Clásico entre los Clásicos

Obligado entonces, Chevy Corvette 1976

Pontiac Firebird 1967. Oh nena!!

La nave espacial. Plymouth Superbird 1970

Que bestia. Pymouth Barrracuda 1971 motor HEMI!!

Chevy Camaro 1969 SS. Para pisarle

Dodge Charger 1968. También conocido como el General Lee

El hermanito. Dodge Challenger 1970

Poderoso el chiquitín! Ford maverick 1972

Ford Thunderbird 1966. Que leeeendo

Plymouth Fury 1958. También "Cristina" el auto malvado

Pontiac GTO 1967. El primer Muscle Car

DeLorean DMC12 1981. Lo reconocen de "Volver al futuro"

Pontiac Trans América 1977. También conocido como KITT, el auto increíble

En el podio. Ford Mustang 1965 convertible. SR. CLASICO

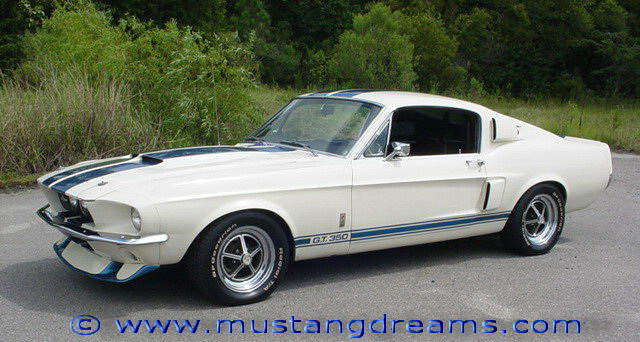

"Eleonora" de "60 segundos" y uno de mis favoritos. Ford Mustang Shelby GT 500 1967

Ford Shelby Cobra 1967. Simplemente hermoso

y para finalizar... probablemente uno de los mejores autos de alto rendimiento jamás construídos, sino el mejor

Ford GT40 1967/69

modelo 2004:

LA YAPA: porque no es americano, pero me entenderán por qué debo incluirlo al hablar de muscle cars. Este auto tenía lo que se conoció como motor "Leviatán" debido a lo cual debieron prohibirse los motores mayores a 5 litros en LeMans durante un tiempo, ya que era imposible superar la potencia de este monstruo. El "Leviatán" consistía en dos motores de 2.9 litros fusionados para dar la ridícula medida de 5.8 litros con 12 cilindros. Empujaba menos de 600 kilos con algo así como 680 caballos de fuerza, para lograr una estúpida velocidad máxima (teórica, ya que la verdadera maxima nunca se pudo determinar exactamente, se imaginan por qué) de más de 570 km/h. Taringueros, sin más preámbulos:

Porsche 917 año 1969. Gerardo dice LA PUCHA!!!

Nada mejor que ver muy buenos autos en un compilado: en Motor Show de a poco vamos reuniendo muchos de los mejores coches que existen en todos los tiempos y hoy tenemos unos muy buenos. No estamos hablando de la lista de los coches del adictivo y sanguinario juego Grand Theft Auto IV y ni siquiera de los automóviles clásicos argentinos que tan en el fondo del alma llevamos. Hoy, tenemos para ustedes las mejores y más musculosas, pesadas y americanas maquinas en 4 ruedas que tanto soñábamos de chicos y, ahora, muchos pueden disfrutar de grandes.

Lo que quier decirles es que en los Bosques de Palermo, Buenos Aires, sucedió todo un acontecimiento para los amantes de los automóviles: precisamente el 31 de agosto pasado el club de Automóviles Americanos en Argentina lograron reunir más de 60 autos conocidos como los clásicos norteamericanos, entre ellos los inigualables Muscle Cars con poderosos motores y unos diseños de los más aguerridos y masculinos (por así decirlo).

Pueden ver en las imágenes a impecables leyendas motorizadas del país del águila como el Corvette, el Cadillac, el Impala, el Camaro, el Pontiac y, uno de los más adorados por la masa con el corcel impregnado en su piel: nada más y nada menos que el furioso Ford Mustang! Entre los vehículos que ven en pantalla, muchos de ellos pertenecen a la década del ’50, ’60, ’70 y hasta ’80 y puede observarse que mantienen intactas sus carrocerías.

Para quienes no conocen a este club de fanáticos del motor americano, les cuento un poco su historia: nace a principios de 1998 cuando Marcelo León conduciendo su Impala SS 64 se cruza con Enrique Leichtner en su Galaxie 61. Luego de un bocinazo y una charla entre ambos nace Automóviles Americanos en Argentina, primero con 10 autos y ahora son más de 90. Una interesante historia, pueden saber más de ellos en su sitio oficial.

LOS CLÁSICOS AMERICANOS | |||

| |||

ASTON MARTIN DB5 | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

ÚLTIMAS NOVEDADES... Y MÁS | ||||||

|

| |||||

| Curiosidades que forman parte de la historia del automóvil aquí | ||||||